south san francisco sales tax increase

A sales tax measure was on the ballot for South San Francisco voters in San Mateo County California on November 3 2015. Select the California city from the list of cities starting with S below to see its current sales tax rate.

2nd Most Valuable U S Startup To Leave Sf As City Loses Another Headquarters

Did South Dakota v.

. As a new half-cent sales tax is set to soon go into effect in South San Francisco officials are further developing a plan for spending the revenue. Argument Against South San Francisco Sales Tax Measure W. South Laguna Laguna Beach 7750.

South Shore Alameda 10750. Measure C in March and Measure W in November. Measure W authorized the city to impose a 05 percent sales tax for 30 years.

CA Sales Tax Rate. SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1. San Mateo Co Local Tax Sl.

29 rows san francisco kron several cities will have a sales use tax hike go. City of San Mateo. Tax returns are required monthly for all hotels and motels operating in the city.

Georgetown kentucky vs south san francisco california. KGO -- The sales tax will go up into the double digits on Wednesday in five Bay Area cities - Albany Hayward Union City San Leandro and El Cerrito. Any guest who stays at a hotel or similar establishment within the city borders of South San Francisco pays the tax.

South Dos Palos. The South San Francisco sales tax rate is. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

With local taxes the total sales tax rate is between 7250 and 10750. Find out with Ballotpedias Sample Ballot Lookup tool City of South San Francisco Sales Tax Measure W November 2015 From Ballotpedia. The County sales tax rate is.

The current Conference Center Tax is 250 per room night. South Lake Tahoe 8750. It was raised.

South San Francisco 9875. South san francisco sales tax increase. Proponents of a sales tax increase in San Mateo County never say die.

Santa Clara County This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax 952. City of South San Francisco. The hike came after voters passed two 05 percent tax hikes in 2020.

California has recent rate changes Thu Jul 01 2021. Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent. Find out whats happening in Alameda with.

The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general fund to be used for. Undeterred by a resounding defeat four years ago they are considering another try at convincing voters to raise the tax rate. The current Transient Occupancy Tax rate is 14.

Measure O increased the City of South San Franciscos hotel tax from 9 to 10. The minimum combined 2022 sales tax rate for South San Francisco California is. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below.

City of San Bruno. Under Measure O hotel guests also have to pay a 10 tax on what they are charged for parking their vehicles at hotel parking structures. Method to calculate South San Francisco sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

4 rows South San Francisco CA Sales Tax Rate. The tax rate here is now 1075 percent. Sales Tax Breakdown South San Francisco Details South San Francisco CA is in San Mateo County.

Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent. California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. City of Los Gatos.

Effective 412021 the current sales tax rate in San Rafael is 925. Over the past year there have been 72 local sales tax rate changes in California. An amgen sign is seen at the companys office in south san francisco california october 21 2013.

When the South San Francisco City Council requests voters grant them a sales tax hike like Measure W what are they sayin. The South San Francisco City Council will host a discussion Wednesday March 30 regarding the spending strategy for money generated by Measure W the half-cent sales tax approved by voters in the. South El Monte 10250.

The san franciscos tax rate may change. This is the total of state county and city sales tax rates. Raised from 975 to 9875 South San Francisco.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. 5 rows The South San Francisco sales tax has been changed within the last year. The California sales tax rate is currently.

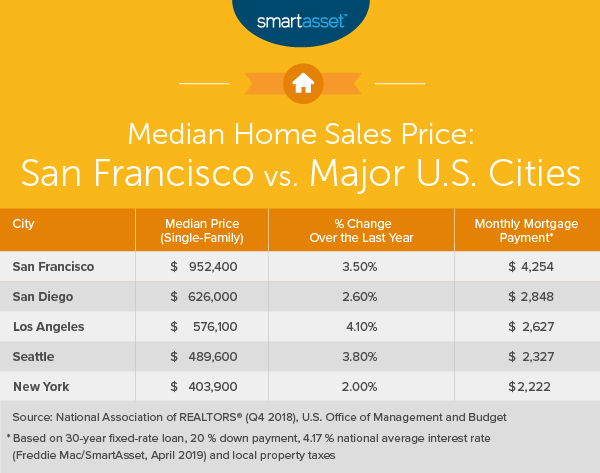

What Is The True Cost Of Living In San Francisco Smartasset

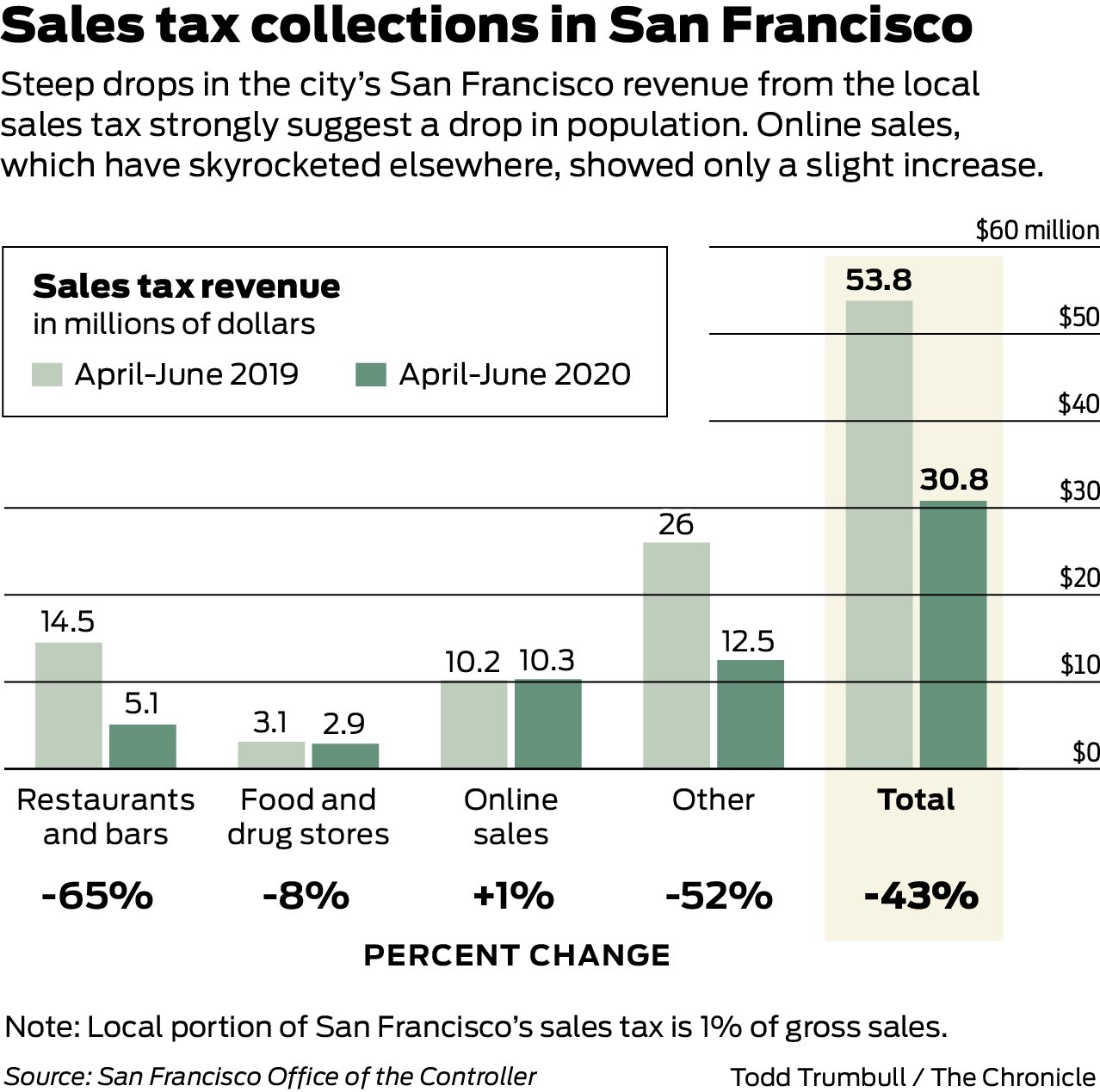

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Measure W City Of South San Francisco

Some San Francisco Bay Area Counties Have Seen Prices Rise More Than 500 In Last 30 Years Mansion Global

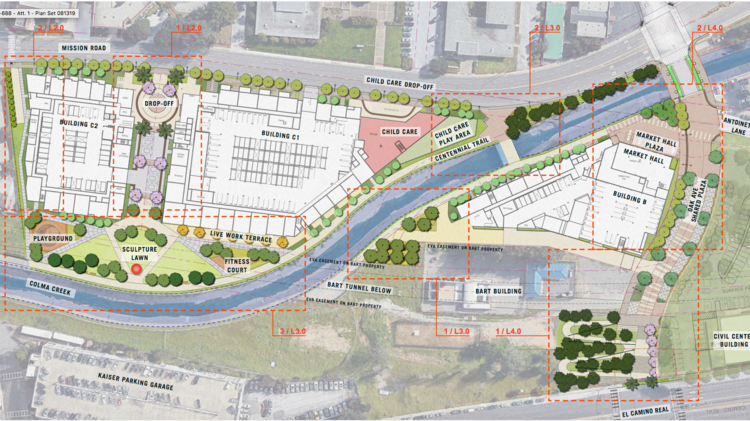

South San Francisco Approves 800 Homes Near Bart At 1051 Mission St San Francisco Business Times

Finance Department City Of South San Francisco

Economy In South San Francisco California

Amgen To Buy Back 6 Bln In Shares This Qtr Provides Long Term Profit Forecast Reuters

There S Still A Window Of Opportunity For San Francisco Condo Buyers Mansion Global

Explore South San Francisco Restaurants Hotels Things To Do

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Explore South San Francisco Restaurants Hotels Things To Do

California San Francisco Business Tax Overhaul Measure Kpmg United States

Measure W City Of South San Francisco

Challenges For That 1 066 Foot Tall Tower As Proposed

2nd Most Valuable U S Startup To Leave Sf As City Loses Another Headquarters